Gynger Capital AR Financing

Advance cash on receivables

Fast, flexible receivables financing with no hidden costs.

Talk to sales

Flexible, upfront payment

Get cash advances on outstanding receivables, including stand alone invoices or entire contracts.

Better than factoring

Access lower fees and more flexible payment terms than traditional factoring. Gynger never underwrites your customer or takes ownership of any invoice.

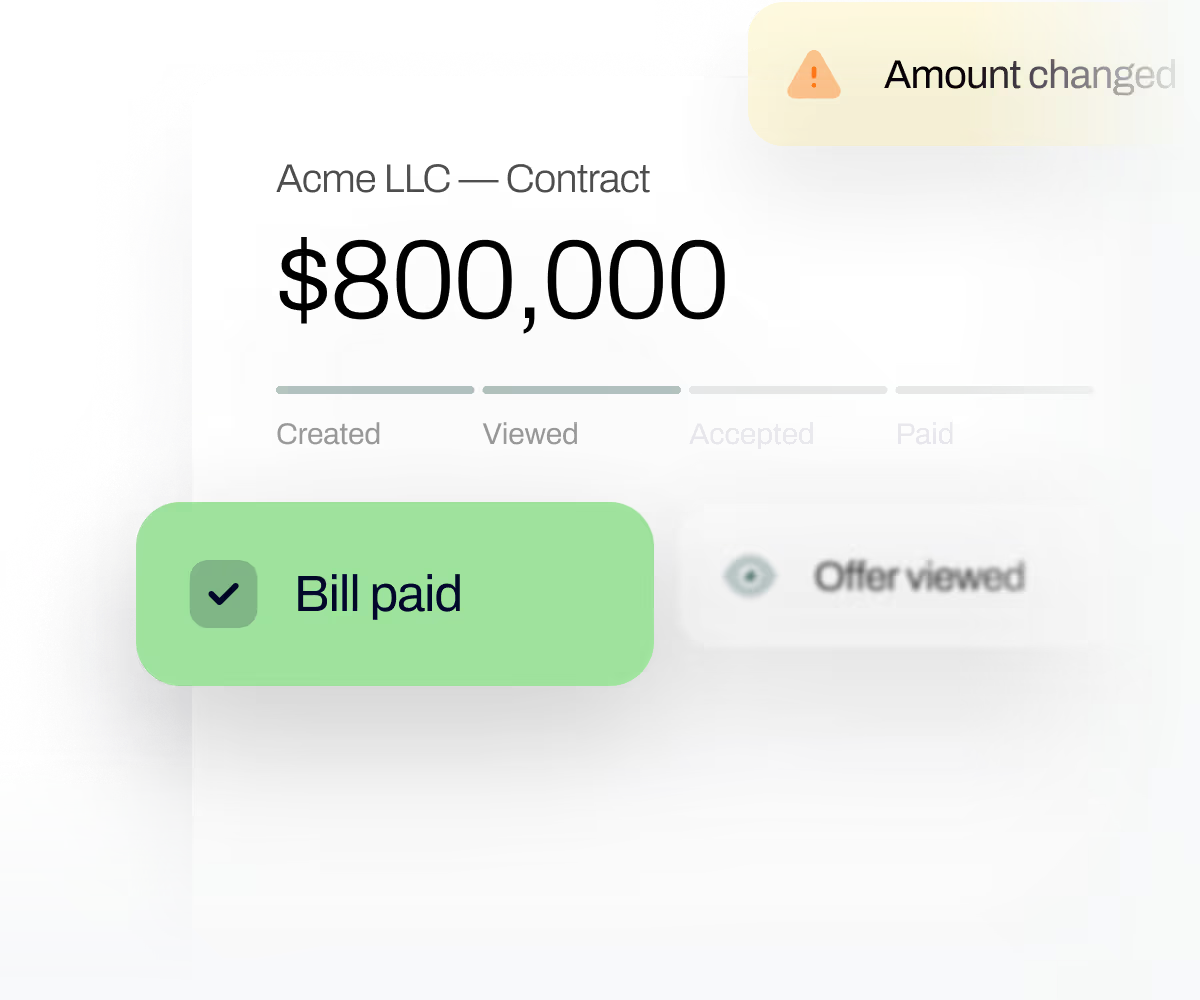

Smarter receivables

Optimize your workflows with Gynger's easy-to-use platform that issues thoughtful recommendations, automates repetitive back-office tasks, and reports in real-time.

Talk to sales

Effortless connection

powered by AI

Easy set up

Launch Gynger same-day with zero dev work required. Gynger embeds seamlessly into your existing workflows and tools.

Explore integrations

Next-day approvals

Instantly access flexible payment options for your business and your customers with AI-powered pre-qualification.

Get started with AR Financing

Fast approvals

Sign up in minutes, unlock next-day approval, and begin submitting your receivables for flexible financing through the Gynger platform.

Flexible payment terms

Gynger offers a range of flexible repayment options that allow businesses to pay us back on terms that work for them.

No dilution or commitment

Gynger offers non-dilutive financing without warrants, commitments, or usage requirements.

Seamless integration

Gynger seamlessly embeds into your existing work flows and systems with no-code integrations to all major CRM, accounting, and banking platforms.

FAQs

What is AR Financing?

Gynger’s AR Financing solution helps businesses manage their receivables more strategically and get access to working capital with fast, flexible financing, freeing up cash from your customer invoices.

What are the advantages of AR Financing?

Gynger enables you to unlock cash from your upcoming receivables. With Gynger, you can:

- Get cash advances on invoices from annual contracts to recurring monthly payments

- Access lower fees than factoring

- Choose customized terms for repayment

What is accounts receivable financing?

Accounts receivable financing is a financial solution that converts unpaid customer invoices into immediate working capital. This arrangement allows businesses to improve cash flow without waiting for payment terms to complete. Gynger offers accounts receivable financing with features such as cash advances on invoices, lower fees than traditional factoring, and flexible repayment options customized to your business needs.

How does accounts receivable financing work?

Accounts receivable financing converts unpaid invoices into immediate capital. The process typically involves applying for financing, getting approved (with Gynger, this happens in as little as 24 hours), selecting which invoices to finance, and choosing repayment terms. Once you sign the agreement, you receive the full invoice amount upfront. Unlike traditional factoring, you maintain customer relationships while repaying Gynger according to your selected terms.

How does Gynger help improve my accounts receivable?

Gynger streamlines your accounts receivable with an intuitive platform that automates tasks, provides real-time reporting, and offers actionable recommendations. The no-code integrations connect seamlessly with your existing CRM, accounting, and banking systems. After quick approval, Gynger advances the full invoice to you. As a new offering, Gynger now gives vendors the option to have Gynger collect from their customers on their behalf, all without disrupting or compromising customer relationships.